The Bitsafe Account demonstrates Bitsafe’s increased focus on customers controlling their own digital assets.

It would be a privilege to have these customers on board,” says Joost Zuurbier. This allows individuals and companies that normally wouldn’t have access to banking to open an account with Bitsafe.

#BITSAFE TO PAYONEER FREE#

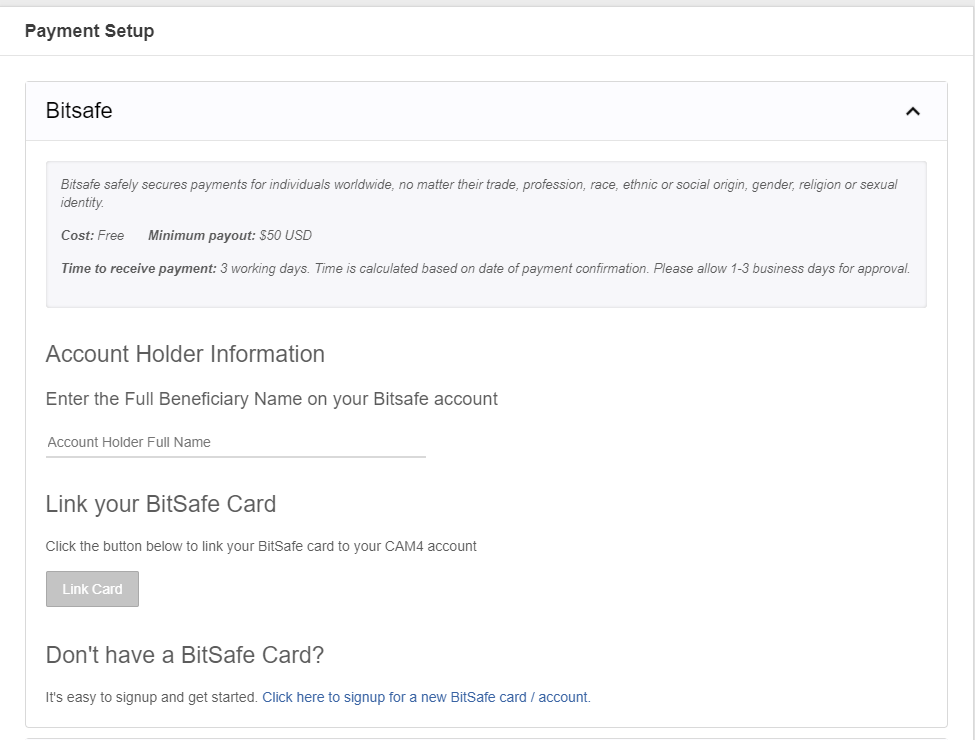

Bitsafe accounts are free of charge and only carry nominal transaction fees. Fees in these countries easily reach 300 Euro or more, just for holding an account. “Customers in some countries, like Italy and Romania, face high annual banking fees. Further exciting developments will include the introduction of the Bitsafe Debit Card, a card product that will allow the account holder to pay and withdraw cash in any global currency. Accounts denominated in US Dollars and British Pounds will soon become available. From today, Bitsafe accounts can be opened on Bitsafe’s website with Euro currency. “The combination of our proprietary merchant processing engine and Bitsafe Borderless Basic Payment Accounts is a unique Process & Pay offering in the market.” We have a track record going back 20 years, and we are able to safeguard money as a regulated financial institution in a modern and stable country,” Trik continues.

#BITSAFE TO PAYONEER REGISTRATION#

Bitsafe however, is the only company that allows registration from any country, and has no income requirements. Our strongest competitors are companies like Payoneer and Paxum. “There are many other players in the Fintech space where Bitsafe operates. With the experience and expertise acquired in the high-risk merchant processing business over the last 20 years, Bitsafe knows what it takes to mitigate risks and has grown into being one of the major and safest global players in the payments market. The company started in San Francisco in 1998 and moved its headquarters to Amsterdam three years later. In the last 20 years it has operated as payment service provider for high-risk merchants and processed for tangible and intangible products and services online.

#BITSAFE TO PAYONEER ANDROID#

Our mobile application, available for both Android and iOS, allows us to identify our account holders fast and efficiently, without a face-to-face meeting.”īitsafe is registered as a regulated Payment Institution. “We have developed a proprietary artificial intelligence technology that has adopted the latest anti-money laundering regulations and can detect illegal activity before a transaction is added to our ledgers. “Opening our accounts to the entire world means that we need to take additional steps to prevent abuse and money laundering,” says Marcel Trik, CFO at Bitsafe. Consumers now have more freedom in managing their own cash and other digital assets such as domain names. With this new legislation, banks will just become utilities that move money around in the background. The European Union has recently adopted new legislation that allows financial institutions other than banks to open up Basic Payment Accounts for their clients. It is a move that is disrupting the global banking industry.īanks have always had a monopoly when it comes to storing people’s money. Today the Dutch company Bitsafe, headquartered in Amsterdam and regulated by the Dutch Central Bank, is paying homage to their roots and again making history as the very first company to offer payment accounts to anyone in the world. The very first joint stock company worldwide was also founded in Amsterdam. In the sixteenth century it was the Provinces of the Netherlands that were the very first ones globally to introduce new financial instruments such as promissory notes and life annuities. This results in zero credit risk and immediate availability of funds,” Zuurbier continues.

Funds in accounts are not stored with another bank, but with the central bank we work with. “All Bitsafe accounts will bear a unique Dutch IBAN. Thanks to new European legislation, Bitsafe is now able to accept customers from all over the world,” says Joost Zuurbier, CEO at Bitsafe. “Residents of a given country are usually limited to opening a bank account with a bank in their home country or region. The new Bitsafe accounts were showcased during the Benzinga Fintech Summit event that was held in downtown San Francisco, a mere stone’s throw away from the location where Bitsafe originally started in 1998. Every Bitsafe account comes with a unique IBAN which allows sending and receiving payments globally, including to and from the SEPA region. Bitsafe account holders can make deposits, make payments and withdraw funds.

A Basic Payment Account works just like a local bank account. During the Fintech Week in San Francisco the Dutch fintech scale-up Bitsafe opened up registrations for its borderless Basic Payment Account to anyone in the world.

0 kommentar(er)

0 kommentar(er)